Many people have questions about the new stimulus bill and we’re here to help provide some answers.

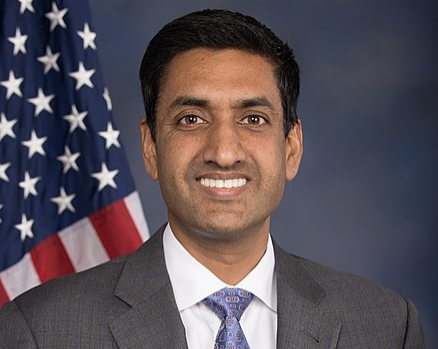

We understand that the new stimulus bill can be confusing and are here to help businesses find the best way forward through this crisis. We are grateful to California Congressman Ro Khanna for connecting with us to answer questions regarding the CARES Act.

Click to watch Q&A sessions with Congressman Khanna:

In addition to those sessions, we have created an online forum to be moderated by Congressman Khanna. Please click below to ask your questions.

For startups not qualifying for support under the CARES Act, there are two other options which are:

- Treasury department’s mid-sized business loan and

- Federal reserve’s lending facility

Startups that have furloughed or laid off employees can qualify by re-hiring them since the CARES Act states “Businesses must maintain the same number of employees (equivalents) from February 15, 2020 through June 30,2020 as it did during either the same period in 2019, or from January 1, 2020 until February 15, 2020.

Whether a startup is operating in an essential category or non-essential will have no bearing on their eligibility for the SBA loan program.

The purpose of the SBA loan program is to help as many startups retain and continue to pay their employees as possible. So, payment to consultants and independent contractors can be included in the payroll costs for the SBA loan.

No, the SBA loan program does not require any personal guarantee.

There is not condition in the SBA loan program limiting the future fundraising capability of startups. So, qualifying and taking the SBA loan program will not prevent (potential) future investments from startups.

There is no limit on the number of companies that will be approved for the SBA loan programs and all startups meeting the requirements will be provided the loans.

Stealth startups can qualify if they’ve a few employees. However, startups with no employees (other than the founder) will not be eligible. In such cases, the founder will be eligible for unemployment insurance benefits.

Health insurance will most likely not be included in payroll costs. However, this needs to be clarified from officers in the list of approved banks.

Share

Share